Appearance

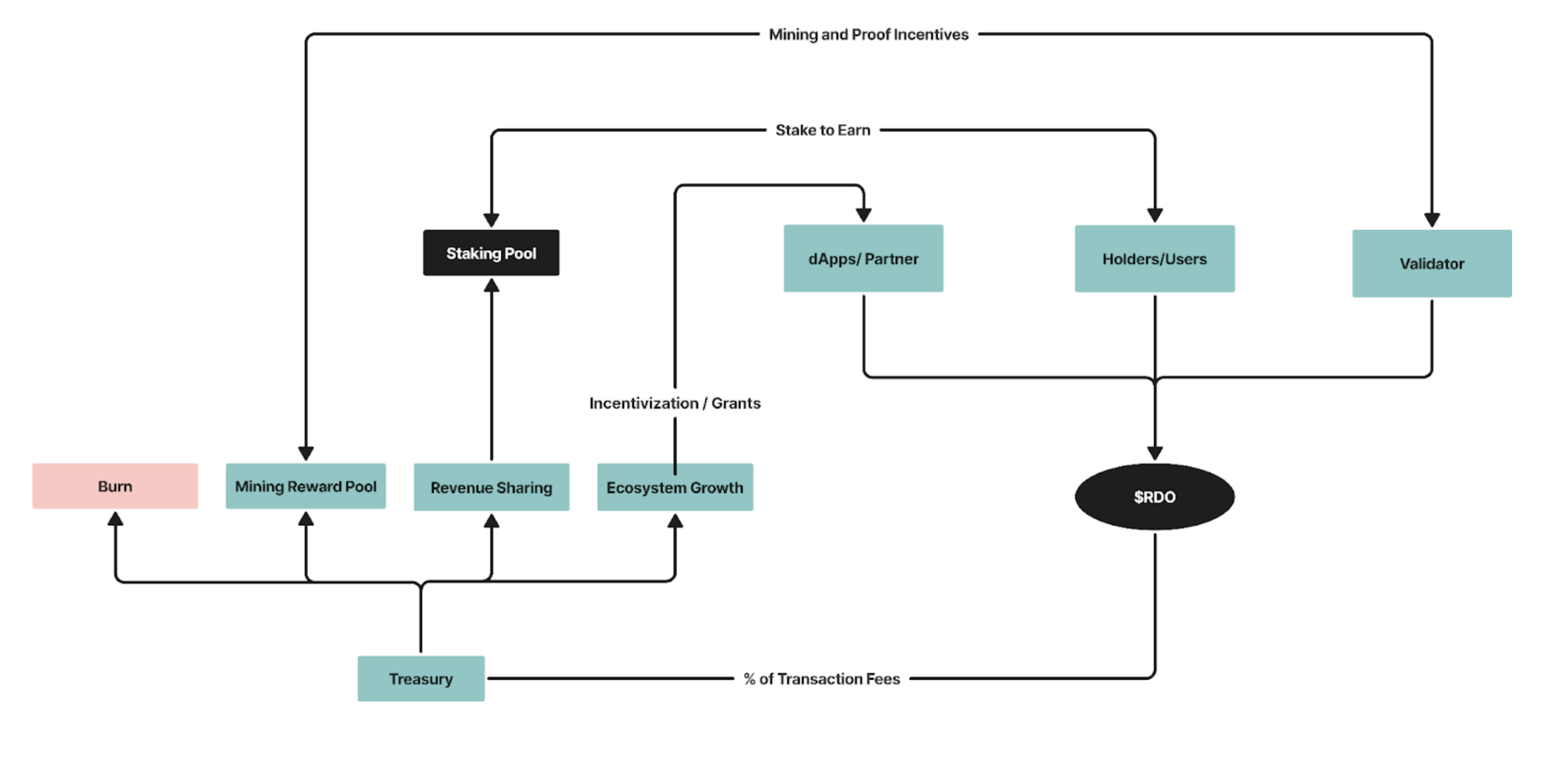

Token Value Flow

The $RDO token operates as the central medium of economic exchange and incentivization within the Reddio ecosystem. Its value flow is strategically structured to align ecosystem growth, validator participation, user engagement, and deflationary mechanisms.

Inflow Sources

The lifecycle of $RDO begins with the participation of key stakeholders—Holders/Users, Validators, and dApp Partners—who acquire and utilize $RDO for core activities such as staking, transaction fees, and network validation.

Transaction Fees: Collected from network usage by users and dApps. A portion of these fees is routed to the Treasury for reinvestment into the ecosystem.

Staking Contributions: Validators and partners stake RDO into the Staking Pool, enabling them to secure the network and participate in consensus.

Treasury Allocations

The Treasury receives a percentage of transaction fees and redistributes them across multiple strategic channels to sustain long-term network performance:

Mining Reward Pool: Allocated to incentivize miners who validate and propose blocks, reinforcing network security.

Revenue Sharing: Disbursed to stakers as staking rewards, creating a feedback loop of incentive for network participation.

Ecosystem Growth: Deployed through grants and incentivization programs targeting dApp developers and ecosystem partners to encourage continued development and innovation.

Burn Program: RDO tokens are periodically burned, reducing supply and creating deflationary pressure.

Outflow & Incentives

Validators receive RDO from the Mining Reward Pool as compensation for block production and proof verification.

Holders and dApps earn RDO via staking mechanisms or grant-based incentives, depending on their contribution to network health or application development. The Burn mechanism supports token value preservation by permanently removing tokens from circulation.

With this structure in place, $RDO derives its strength from clearly defined utilities that power the operational, economic, and governance layers of the Reddio network. Each utility ensures that the token remains indispensable across all user interactions and infrastructure processes. The following sections outline the key utilities of $RDO in detail:

1. Transaction Fees

$RDO is used as gas fees for network operations. All network interactions, including contract deployments and token transfers, require $RDO as the base transactional currency. This utility ensures continuous demand as network usage grows.

2. Stake to Earn

Staking $RDO is a crucial element in enhancing engagement within the Reddio ecosystem, offering several key advantages to token holders:

Redistribution of Profits (Transaction Fees)

By staking $RDO, users can earn some percentage of the profits generated. This is distributed among stakers, providing long-term participation in the ecosystem.Boosting Ecosystem Metrics (TVL, Volume, etc.)

Staking also plays a critical role in increasing the Total Value Locked within the Reddio ecosystem. High TVL is an essential indicator of the platform’s health, trust, and popularity. As more users stake $RDO, the ecosystem gains increased visibility, attracting more users and investors, which drives further growth, increases trading volume, and strengthens the overall network.

3. Stake to Validate

Validators are required to stake $RDO tokens to participate in the Reddio network's consensus mechanism, which is based on Proof-of-Authority (PoA). This staking requirement ensures that only committed, identifiable, and accountable parties are involved in block validation and sequencing. The PoA framework minimizes malicious behavior and increases network trust by linking validator eligibility to both computational contribution and economic stake.

Securing the Network

Staking to validate forms the backbone of Reddio’s security model. Validators who stake $RDO are incentivized to act in the best interest of the network, as any malicious behavior could lead to loss of reputation and staked assets.

Economic Alignment

This approach aligns economic incentives with network integrity, ensuring that validators are financially motivated to maintain high performance, honest behavior, and operational reliability.

4. Burn Program

The Burn Program is a deflationary strategy designed to enhance the value of $RDO by reducing its circulating supply over time. Up to 20% of the transaction fee is allocated to be burned from the circulation.